The State Of Credit Union Governance 2020

Key findings include diversity as a priority and a desire to increase focus on strategy.

For years, we’ve dreamt of studying the state of credit union governance. We know what you’re thinking: Dream bigger. Some people dream of European vacations. Fast cars. Beach houses. But for governance geeks like us, it’s often all about the data.

In 2018, we were fortunate to partner with CUES to realize our dream, and The State of Credit Union Governance, 2018 was published. We made some groundbreaking discoveries, like reporting that board members and CEOs frequently differ on their perceptions about governance—and that their perceptions diverge even further based on tenure. We even found that bigger really may be better: Board members and CEOs of CUs with assets of $1 billion or greater had statistically and significantly higher survey scores overall on 18 of the 21 key questions asked concerning matters of governance. And we were satisfied, for a while.

But our compendium of data kept growing, and our drive to create more information for you, our colleagues, clients and friends throughout the credit union community, was compelling. Today, we are pleased to announce The State of Credit Union Governance, 2020, which provides updated figures for 2018-2019 and draws on data from the governance assessment of 115 additional credit unions—114 in the U.S. and one based in Jamaica—to enrich the findings from our 2018 report.

This year’s report is a collaboration between CUES, Quantum Governance and The David and Sharon Johnston Centre for Corporate Governance and Innovation at the Rotman School of Management, University of Toronto. Our findings are also derived from a supplemental online survey conducted in September 2019 with responses from 320 directors and CEOs across 170 U.S. credit unions.

While many of the key findings from 2018 still ring true today (if you haven’t read the 2018 report, we encourage you to begin there), the 2020 report is full of new discoveries that will challenge you and your credit union to new levels of governance excellence.

2020 Key Findings

Board Structure and Composition:

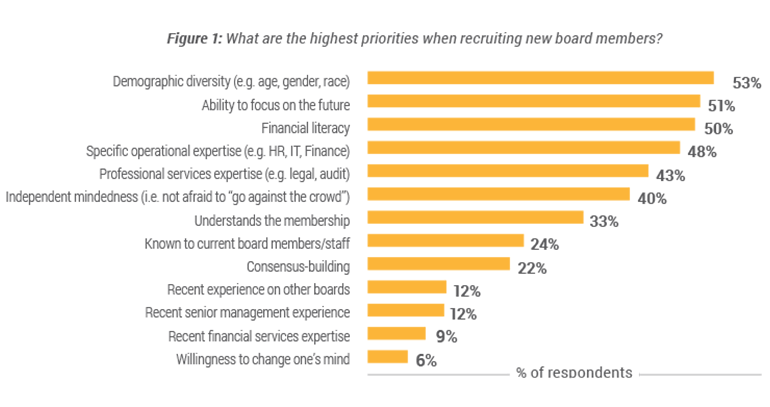

- Demographic diversity was identified as the number one priority for credit union board recruitment (53%). The next highest priority identified when recruiting new members to credit union boards was an ability to focus on the future (51%). (See Figure 1.)

- Board members continue to think that soft skills, such as an ability to focus on the future (76%) and independent mindedness (66%), are most valuable in the boardroom.

- Credit union boards are more gender-diverse than their counterparts in other sectors. The average credit union board has nine members, of which three are women (36%) and one is a visible minority (16%).

Board Governance:

- Credit union boards that focus on bolstering their governance tend to adopt a governance committee more readily than those that do not have a concerted focus on good governance.

- When looking closely at the 1,060 director responses in our sample, we found that directors on the same board would often report very different—and sometimes opposing—perspectives on their board’s effectiveness in four fundamental areas of board renewal: 1) periodic governance assessment; 2) the action plan based on governance assessment outcomes; 3) the director onboarding process; and 4) the frequency of board member renewal.

Board Leadership:

- Survey respondents identified seven important leadership functions for board chairs that fall within two primary categories: 1) establishing processes (e.g., allocating time, setting the agenda, etc.); and 2) working with people (e.g., appointing committee members and chairs).

- Although most survey participants report that their boards do not limit the number of terms a board chair can serve, we found that more than a third do. Term limits for board chairs can range anywhere from a year to more than 10 years. More than half of the participants whose boards have a term limit in place for their chairs reported limits of less than five years.

- An impressive 92% of all surveyed board members report that their board is effective at maintaining a good working relationship with their CEO.

- However, as in the 2018 report, the average board member and CEO differed on how effective they thought their boards were on a range of key governance measures. In 2020, across the 81 surveyed CUs that provided a CEO response, we found that there’s disagreement between the board and CEO regarding the board’s effectiveness on 22 out of 49 survey questions, on average.

Credit Union Strategy:

- We found that 32% of survey respondents do not feel that their board is effective in helping to develop the credit union’s vision, mission and strategy.

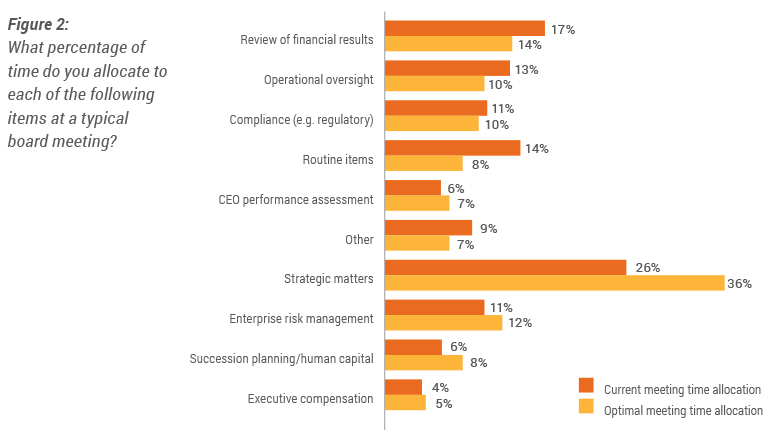

- Most survey respondents say they should slash—by a third—the average time they spend on routine items and operational oversight (i.e., items that do not require debate or can be approved with a single motion as on a consent agenda) and invest an average of 10% more of their time on strategic matters. (See Figure 2.)

Decision-Making:

- Many credit unions have at least one director who says that the board is ineffective at asking hard questions (53%), holding each other accountable (54%) or engaging all members in the work of the board (49%).

- While directors had misgivings about how decisions are reached, most believe the decisions their boards made were ultimately good, and they could stand by them and speak with one voice.

Recommendations

Since many of the findings from the 2018 report remain relevant, we encourage you to revisit those recommendations as a baseline; they will serve you well as strong building blocks for any governance program. From there, we would encourage you to consider our newest recommendations from the 2020 report:

- Board Renewal: Focus on strategic thinking and independent mindedness. Your credit union is a complex financial institution navigating the era of greatest change in the history of the credit union movement. As a result, your board requires meaningful financial literacy, business acumen and specialized skills in such specialties as law, accounting and human resources. However, even boards with the most skilled members will fail to add value without independent mindedness and strategic thinking.

- Board Diversity: More than ever, credit unions are acknowledging the value of demographic diversity among board members, including gender, race/ethnicity and age. However talking about it as a priority is not enough. To ensure that your board is truly diverse, you will need to be clear in your objectives and work hard at executing them. Once you know the demographic balance you are looking for, you will need a plan to help you find the right people.

- Board Leadership: Take your board chair position very seriously. Although your CEO is responsible for carrying out your credit union’s strategy on a day-to-day basis, no individual in your credit union has more potential to add value than your board chair. Ensure that you have a robust, concrete job description in place for this important position.

- Board Governance: Build alignment around what “effective” truly means. It is both normal and constructive for board members to disagree. One might argue that without disagreement there can be no excellent decisions. In too many cases, however, our data highlights boards where one or more directors have assessed the board’s effectiveness at polar opposite ends of the spectrum. Ensure that you are engaging in these types of conversations in the boardroom—what does “effective” really look like for you?

- Strategic Thinking, Learning and Planning: Invest more time in strategic matters. The most valuable skill identified in credit union boardrooms today is the ability to focus on the future, yet we found that 32% of survey respondents do not feel that their board is effective in helping to develop the credit union’s vision, mission and strategy. Ensure that your board is doing everything it can to be effective in this fundamental role and responsibility.

CUES members can download their free copy of the 2020 report at cues.org/govreport2020. cues icon

Jennie Boden is VP/strategic relationships at CUES strategic partner Quantum Governance L3C, Herndon, Virginia. Tony Spizzirri is senior research officer for The David and Sharon Johnston Centre for Corporate Governance Innovation at the Rotman School of Management, University of Toronto. Manini Sheker is research officer at The David and Sharon Johnston Centre for Corporate Governance Innovation.